Introduction to Eversend

Eversend is a digital financial services platform designed to provide a range of banking solutions without the traditional banking infrastructure. More so, it is a one-stop shop for multi-currency wallets, currency exchange, virtual cards, bill payments, and more. Eversend aims to make financial services accessible, affordable, and convenient for everyone.

Getting Started with Eversend

- Creating an Account : Starting with Eversend is straightforward. Download the Eversend app from your preferred app store. Open the app, click on “Sign Up,” and enter your basic information such as name, email, and phone number. Follow the prompts to create a secure password.

- Verifying Your Identity : Eversend prioritizes security and compliance. To verify your identity, you’ll need to provide a government issued ID and a selfie video. This process ensures that your account is secure and complies with international financial regulations.

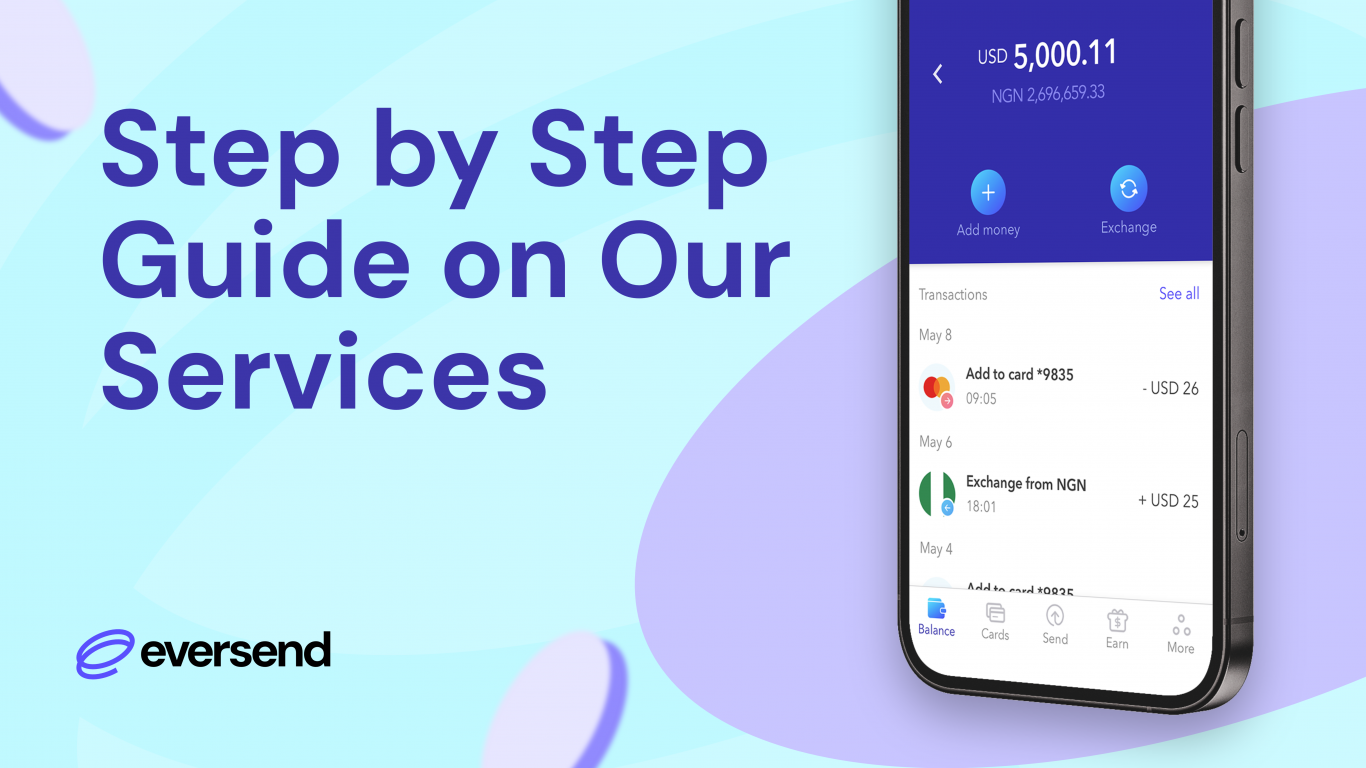

Navigating the Eversend Interface

Dashboard Overview

The Eversend dashboard is user-friendly and intuitive. Upon logging in, you’ll be greeted with an overview of your account balance, recent transactions, and quick access to essential features.

Key Features at a Glance

Eversend offers a range of features accessible from the main dashboard. These include sending money, currency exchange, managing multi-currency wallets, creating virtual cards, airtime purchases, and paying bills. Each feature is designed to be easily navigable, ensuring a seamless user experience.

Adding Funds to Your Eversend Account

- Funding via Bank Transfer : To add funds via bank transfer, navigate to the “Add Funds” section, select “Bank Transfer,” and follow the instructions to transfer money from your bank account to your Eversend account.

- Funding via Credit/Debit Card : You can also fund your Eversend account using a credit or debit card. Select the “Credit/Debit Card” option, enter your card details, and specify the amount you wish to add.

- Funding via Mobile Money: Eversend supports funding through mobile money platforms. Choose the “Mobile Money” option, select your mobile money provider, and follow the steps to complete the transfer.

Sending Money with Eversend

- Domestic Transfers :Eversend allows for quick and easy domestic transfers. Select the “Send Money” feature, and enter the recipient’s details and the amount. Confirm the transaction to complete the transfer.

- International Transfers :For international transfers, Eversend provides competitive exchange rates and low fees. Choose the recipient’s country, enter the required details, and confirm the transaction.

Eversend Multi-Currency Wallets

- Understanding Multi-Currency Wallets :Eversend offers multi-currency wallets that allow you to hold and manage multiple currencies within your account. This feature is ideal for users who frequently transact in different currencies.

- How to Use Multi-Currency Wallets :To use multi-currency wallets, simply navigate to the “Wallets” section, select the currency you wish to add, and follow the prompts to fund and manage your wallets.

Currency Exchange with Eversend

- Real-Time Exchange Rates : Eversend provides real-time exchange rates, ensuring that you get the best possible rate for your currency conversions. The rates are updated continuously to reflect market changes. To execute a currency exchange, go to the “Exchange” section, select the currencies you wish to convert, enter the amount, and confirm the transaction. The exchanged funds will be available in your selected wallet instantly.

Paying Bills with Eversend

- Utility Bills : Eversend makes it easy to pay utility bills directly from your account. Navigate to the “Pay Bills” section, select the utility provider, enter your account details, and confirm the payment.

Eversend Virtual Cards

- Generating a Virtual Card: Eversend offers virtual cards that can be used for online transactions. To generate a virtual card, go to the “Virtual Cards” section, click on “Add New Card,” and follow the prompts. You can manage your virtual

- cards by viewing transaction history, and temporarily freezing or deleting the card if needed.

Eversend B2B Solutions

- Business Accounts : Eversend offers tailored solutions for businesses, including business accounts that come with additional features such as bulk payments and multi-user access.

- Bulk Payments : Businesses can take advantage of the bulk payments feature to send payments to multiple recipients simultaneously, saving time and reducing administrative burden.

Eversend Rewards and Loyalty Program

- How to Earn & Redeem Rewards : Eversend offers a rewards program where users can earn points for various activities such as transactions, referrals, and more. Redeem your accumulated rewards points for discounts, free transactions, or other perks directly from

Customer Support and Help

- Accessing Support : Eversend provides robust customer support accessible through the app. Visit the “Help” section to chat with support representatives or browse the knowledge base.

Conclusion

Eversend offers a wide array of financial services that are accessible, secure, and user-friendly. From multi currency wallets to bill payments, it simplifies financial management. Even more, Eversend is a powerful tool for modern financial management, bridging gaps in traditional banking and empowering users with innovative solutions. Whether for personal or business use, Eversend stands out as a comprehensive and reliable financial partner.

Related Articles