Introduction

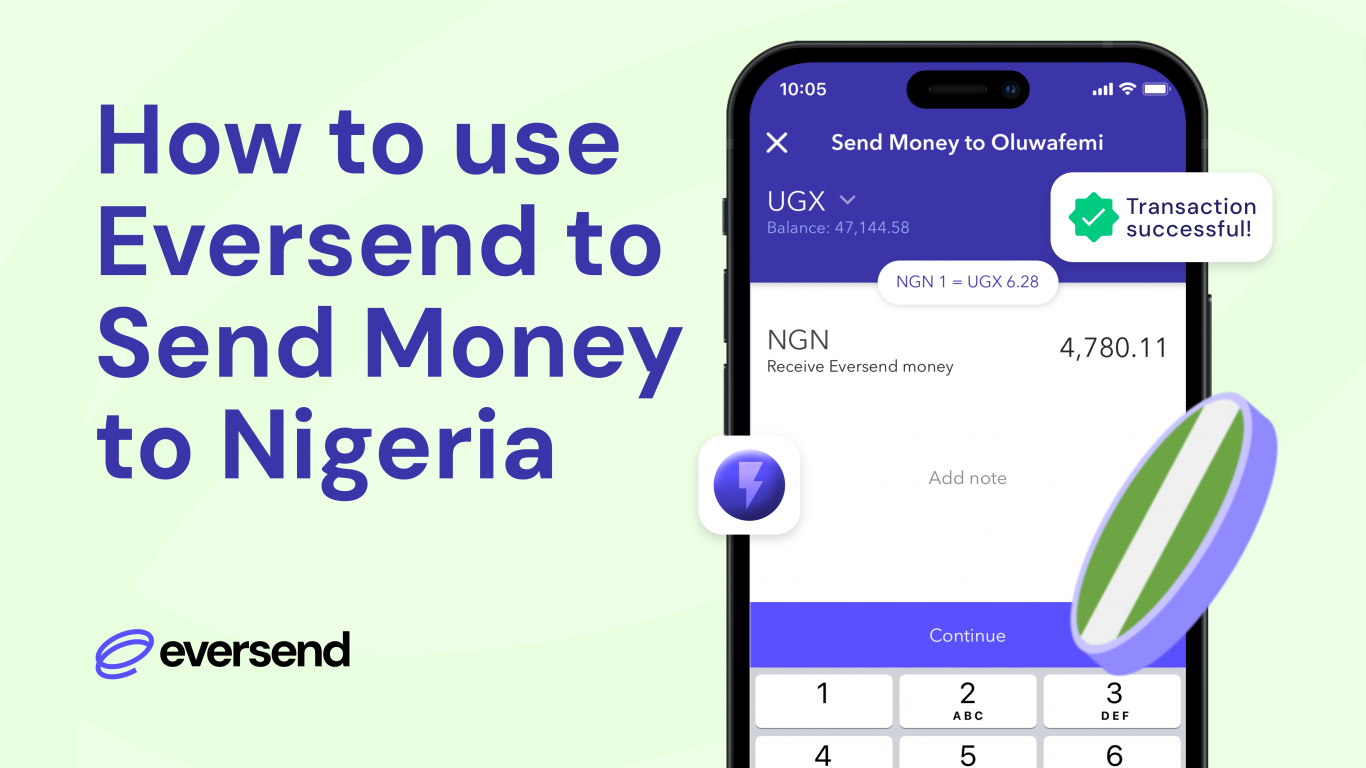

Digital financial services have revolutionized the way we handle money. Whether it’s paying bills, shopping online, or sending money across borders, the Eversend is making financial transactions seamless and secure. If you need to send money to Nigeria, Eversend offers a reliable and user-friendly platform to ensure your funds arrive quickly and safely.

Setting Up Your Eversend Account

Getting started with Eversend is simple. First, download the app from the App Store or Google Play. Once installed, open the app and start the registration process by entering your phone number and personal details. To ensure the security of your account, Eversend requires identity verification, which involves uploading a photo ID and a selfie video.

Adding Funds to Your Eversend Wallet

To send money, you’ll need to add funds to your Eversend wallet. You can do this by linking your bank account or debit/credit card. Eversend supports funding via bank transfer, stable coins, and direct card payments in Nigeria, giving you flexibility in how you manage your wallet. The process is straightforward, ensuring that your wallet is funded and ready for transactions in no time.

Understanding Exchange Rates and Fees

Eversend prides itself on transparency, offering real-time exchange rates and a clear fee structure. Unlike traditional banks that often have hidden fees, Eversend provides a detailed breakdown of costs before you complete your transaction. This transparency helps you make informed decisions and ensures you get the best value for your money.

Add Beneficiaries on the App

A beneficiary refers to a person who receives benefits from a particular entity. When making a payout, think of a beneficiary as the recipient.

To add a mobile number beneficiary:

∙ Open the app, click “Send.”

∙ Click on “Mobile”

∙ On the top right-hand corner, click “the Plus sign”

∙ Follow the on-screen instructions to add a beneficiary.

∙ Finally, click “Save as beneficiary” to complete the process.

To add a bank beneficiary:

∙ Open the app, click “Send”.

∙ Select “Bank”.

∙ On the top right-hand corner, click “the Plus sign”

∙ Select the recipient’s country and add the recipient’s phone number and name. ∙ Click “Include bank details”.

∙ Select the beneficiary’s bank name and add the bank account and account name. ∙ Finally, click “Save as beneficiary” to complete the process.

Choosing the Transfer Method

Eversend offers multiple methods for transferring money to Nigeria. You can choose to send funds directly from the app or by using the recipient’s Eversend tag you can send funds to Nigeria seamlessly.

Initiating a Transfer to Nigeria Using the App

Sending money to Nigeria with Eversend is a breeze.

- Start by opening the app and selecting the “Send” option.

- Choose your recipient from your contacts or enter their details manually.

- Specify the “Amount” you wish to send and select the “Currency”.

- The app will display the exchange rate and fees, allowing you to review everything before confirming the transfer.

Initiating a Transfer to Nigeria Using a Tag

- Go to e.g https://eversend.me/

- You will be redirected to the payment platform.

- Choose your country’s flag.

- Enter the amount you want to send.

- Provide your name.

- Add notes to describe the transaction (optional).

- Click “Continue”.

- Alternatively, you can scan the QR code to send from your Eversend app.

- Enter your phone number.

- Select how you want to receive your OTP (One-Time Password). Please note that your account will be debited from this number.

- Click “Continue”

- Enter the OTP code sent to your phone number to confirm the transaction. ∙ Review the transaction details.

- Click “Make Transaction”.

- A prompt will be sent to your mobile money number.

- Go to your phone to complete the transaction by inputting your mobile money pin ∙ The transaction might take up to 10 minutes to be delivered

Tracking Your Transfer

One of the standout features of Eversend is its real-time tracking. After initiating a transfer, you can monitor its progress within the app. Eversend sends notifications and updates at each stage of the transfer, so you are never left in the dark. If there is a delay, the app provides guidance on the next steps and how to resolve any issues.

Ensuring Security and Compliance

Security is paramount when handling financial transactions, and Eversend takes it seriously. The app employs advanced encryption and security protocols to protect your data. Additionally, Eversend complies with international financial regulations, ensuring that all transactions are secure and legitimate. As a user, it’s essential to follow best practices, such as using strong passwords or pins.

Customer Support and Troubleshooting

If you encounter any issues, Eversend offers robust customer support. You can access support through the app, where you will find FAQs, chat, and email options. Common issues, such as delays or wrong transfers, are addressed promptly. The support team is dedicated to ensuring a smooth and hassle-free experience for all users.

Conclusion

Sending money to Nigeria using the Eversend app is a reliable, fast, and cost-effective solution. With its transparent fee structure, real-time tracking, and robust security measures, Eversend ensures your funds are transferred safely and efficiently. Give Eversend a try for your next money transfer and experience the convenience of modern digital financial services. The future of international money transfers is here, and it’s digital.

Related Articles

Eversend – Affordable Money Transfer in Africa