Stablecoins: cryptocurrencies pegged to an asset such as the U.S. dollar, usually backed by equivalent value. Examples of stablecoins are USDC, USDT, BUSD, USDP, etc.

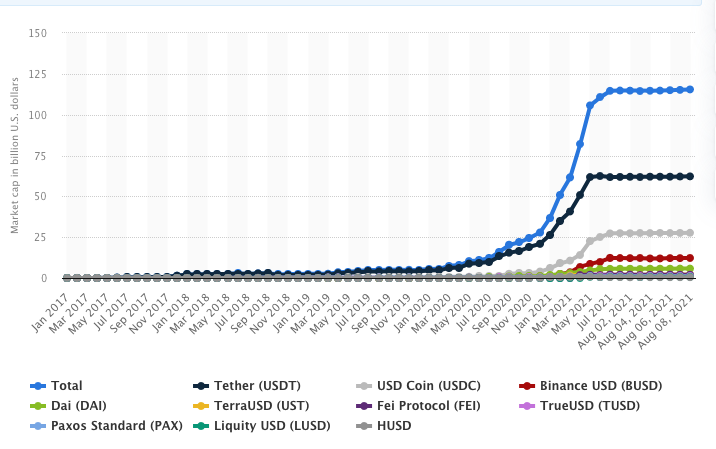

In recent days, we have heard calls from U.S. authorities to regulate stablecoins. This kind of attention only comes up if something is systemically important to the financial system. More than $115b in stablecoins value has been issued to date. Source (Statista)

Today, business payments are made through the SWIFT messaging system, debit and credit cards, or direct bank transfer, e.g., ACH. These traditional payment systems have significant disadvantages, including high transaction costs, slow delivery and settlement, fraud, and inconvenience.

Processing cards costs about 3% on average; SWIFT transfers cost between $40 and $90. If the payment is across borders or cross-currency, there is an additional 2%-5% in foreign exchange commissions. Card processors take as long as 2–5 days to settle funds to any merchant. When you pay a business using a card, they will see the funds in their accounts after 2 to 5 days. SWIFT transfers take 2 to 7 days, and sometimes the money disappears for months (true story). Card payments are notorious for fraud and chargebacks. The consumer may be protected most times if a credit card is used. However, the merchant is usually liable for chargebacks (pray for African fin-tech companies that accept cards).

Enter stablecoins. The beauty of stablecoins is that they solve all these problems. Most transactions will cost about $0.1 to $10 (damn ETH/ERC20) in gas fees and take about 5 seconds to settle at the recipient side.

A fin-tech company moving money for float across continents can use stablecoins. Are you importing goods from China? Send stablecoins, and the money is delivered in 5 seconds. A government could run stimulus cash transfers to citizens instantly (printer go brrrr).

I see stablecoins offered as a payment option by leading payments service providers soon.

At Eversend, we are betting on stablecoins for liquidity management, treasury management, and payments processing for some of our customers. If you are a business that would like to take advantage and accept or make payments using stablecoins, reach out to us. Not only are we providing the infrastructure for stablecoin payments, but we are also collecting and settling in fiat currencies.

Related Articles