What power does a (digital) bank account hold? We explore the power of fintech and digital bank accounts, forming a bridge to financial stability and economic empowerment.

All around the world, 1.7 billion adults lack access to formal financial services. This is often referred to the state of being “unbanked” — being without a bank account at a financial institution or through a mobile money provider. In a bid to bring economic empowerment and fulfil Sustainable Development Goals, actors of the international community — from the United Nations, World Bank, governments to private firms — is joining forces to bring banking to everyone — through digitalisation. What difference does a bank account make? And how does financial technology and what we offer at Eversend fit into all this?

Recap

Last week, we laid out the international network formed to bring formal financial services to all and financial technology’s key role in the so-called “financial inclusion” agenda. All around the world, mobile wallets and other innovations are helping us overcome traditional barriers to banking — cost and distance.

“Mobile money,” like what we are building here atEversend, is a service in which the mobile phone is used to access financial services. You can set up a “mobile wallet.” The multi-currency e-wallet becomes an account accessed using your mobile phone, from which you can make mobile payments internationally at the best rate, save, access loans, get insurance, and other services.

So why does a bank account matter to economic empowerment?

Let’s break this down to four formal financial services and how they can be used for individual economic empowerment. Namely: multi-currency payments, savings, credit, insurance.

Function #1: Multi-currency transactions

Sending and receiving money at the lowest rates

In 2018, US$528 billions worth of remittance was sent to developing countries. Remittance is the transfer of money from residents working abroad to their home country. As shown by global migration trends, people are moving across borders for jobs, education, and families. Payments from citizens abroad have become “developmental vehicles” for some countries. In fact, some economies have grown highly dependent on remittance, making up over 20% of their GDP (see Gambia, Liberia and Nepal).

Photo by Keegan Houser on Unsplash

With digital financial transactions, we make sure you can quickly receive from and send money to loved ones afar.

Whether this is used to fund basic necessities such as food, healthcare, rent or education, the ability to access additional income quickly and reliably from abroad translates into financial stability for families. This also mitigates the impact of unforeseeable financial emergencies.

Moreover, we work to provide the lowest rates possible.

$25 billion is lost due to high remittance commission fees around the world every year.

Globally, the cost of sending remittance averages at 7% of the payment — 4% points higher than the UN Sustainable Development Goals target of 3% to be met by 2030. For the African diaspora, the cost is doubled at 12%. Traditionally, migrant workers relied on bank account transfers, credit and debit cards. Of course, money can also be physically smuggled home by friends and family, but sending it over with a tap on the phone is way easier and quicker.

Out of all methods available, mobile money and wallets like ours have become the cheapest and quickest option to fund and receive remittance payments.

The emergence of fintech startups like Eversend introduces competition to a market previously dominated by only a few money transfer operators — notably Western Union and MoneyGram.

We get to do this because of a much leaner operational model. Powered by blockchain, we can run from a headquarter and reach users through mobile networks, with some local partnerships to serve as cash points. This cuts out the expensive overhead costs to power traditional bank or transfer branches. Western Union, for example, maintains over 550,000 agent locations globally. That’s more than McDonald’s 36,000 stores. Without the costs of sprawling physical locations, mobile-based money services offer reduced commission fees and delivery time for remittances.

Looking forward, e-wallets also has huge potential in governmental welfare transactions. Governments that switch to digital payments effectively reduce the money lost to corruption and time spent on travelling and waiting to acquire benefits. In a study on Niger, this racks up to an average of 20 hours saved per person over a five-month study! That’s many hours that could have been spent on work, family, or basically anything but queuing. We’ll be waiting for this to catch on.

According to the UN, when we finally hit the 3% average remittance cost target, $1 billion more will be spent on education in the developing world. And we say that’s a good thing.

Function #2: Savings

A more secure way to keep your value

Photo by from Standard Media Kenya

A bank account is a more secure way to safeguard savings against two common human weaknesses — theft and temptation.

High volumes of savings in cash are extremely vulnerable to theft. Research also concludes that households under economic distress without access to saving accounts find it difficult to resist temptations of immediate spending.

Local informal saving services are sometimes available, but these often incur substantial administration fees and are unregulated.

E-wallets are becoming an accessible formal saving mechanism to facilitate the accumulation of capital. So that people can more easily manage cash flow spikes and mitigate financial shocks, e.g. unplanned medical costs and natural disasters. As a result, you build long term resilience against financial insecurity and extremities. This means more money to invest in families (such as better nutrition, real estate, etc.), to start and to grow businesses, and generate wealth.

Function #3: Insurance

Safeguarding for when life rains on your parade

Insurance helps protect against financial loss and maintain a continuous income stream. This does more than preventing financial insecurity and extreme hardship. With the guarantee that losses will be covered, more micro-entrepreneurs are encouraged to make riskier but higher-return investments.

We see this in agriculture for example. This means shifting from subsistence farming to risker cash crops that generates income. This also translates to the confidence to grow in scale. Farmers purchase more fertilisers, plant more acreage, hire more labour as they are less concerned by the possibility of these investments being lost to unfortunate circumstances. As a result, they end up with higher yields and income.

Photo by Doug Linstedt on Unsplash

It’s been found that returns to the same work and increased capacity allows more monetary resources in families to raise children. Less meals are missed. Less classes are skipped because children’s labour are no longer needed at the family business or farm.

Function #4: Credit

For the micro-entrepreneurs and homeowners of today

Credits help grow micro-businesses. And the ability to do so unleashes the great potential held in poor and informal economies.

With underdeveloped labour markets, poorer countries see higher participation rates in the informal economy. Without access to fixed wage employment, income is earned through all forms of hard-work and micro-entrepreneurship.

But setting up any form of business can be expensive, let alone growing and keeping it afloat amidst financial shocks and risks. Even if it pays off in the long run, the lack of initial capital or general hesitance to tap into savings means that possible endeavours remain uninvested in.

Eversend is working to provide loans to our users, so everyone can get the capital they need to finally start that business.

When living in a developing country, two main problems may arise when you try to borrow. First, being physically out of reach from a credible lending institution. Second, when you’re unbanked, it is simply impossible to assess your trustworthiness when you have zero financial track record.

Without access to formal credit institutions, unbanked families may turn to traditional informal loans, e.g. pawn-brokers, moneylenders, and relatives. This opens families up to exploitative rates due to lack of regulation, while the funds available may be insufficient to meet actual needs.

Today, fintech helps poor families access more reliable, transparent and cheap credit. We are working to leverage this.

Did you know that firms can now create credit scores by predicting behaviour from users’ call and text message patterns? They can also predict how credible ‘thin-file’ borrowers are through behavioural data generated when on online games and quizzes. Mobile phones connect services to people, while innovations overcome credit-scoring difficulties.

And what happens loans are possible? From income, size, scale of agricultural activities, to livestock diversification — microbusinesses grow and bring wealth to those who own them.

“Lack of access to financial service entraps the poor and vulnerable segments of the society in the vicious cycle of poverty, making it harder for them to to fully participate in the economy.”

Prof. Florence Luoga, Governor or Bank of Tanzania

We started with one inspired young man fixing the perils of sending remittances to her grandma in Uganda.

Now we’re building the financial octopus for Africa and beyond.Driven by a human-centric approach, we’re proud to share the Eversend e-wallet with our users.

And we invite you to join us on our journey. Pushing us all closer to individual economic empowerment and global Sustainable Development Goals, one transaction at a time.

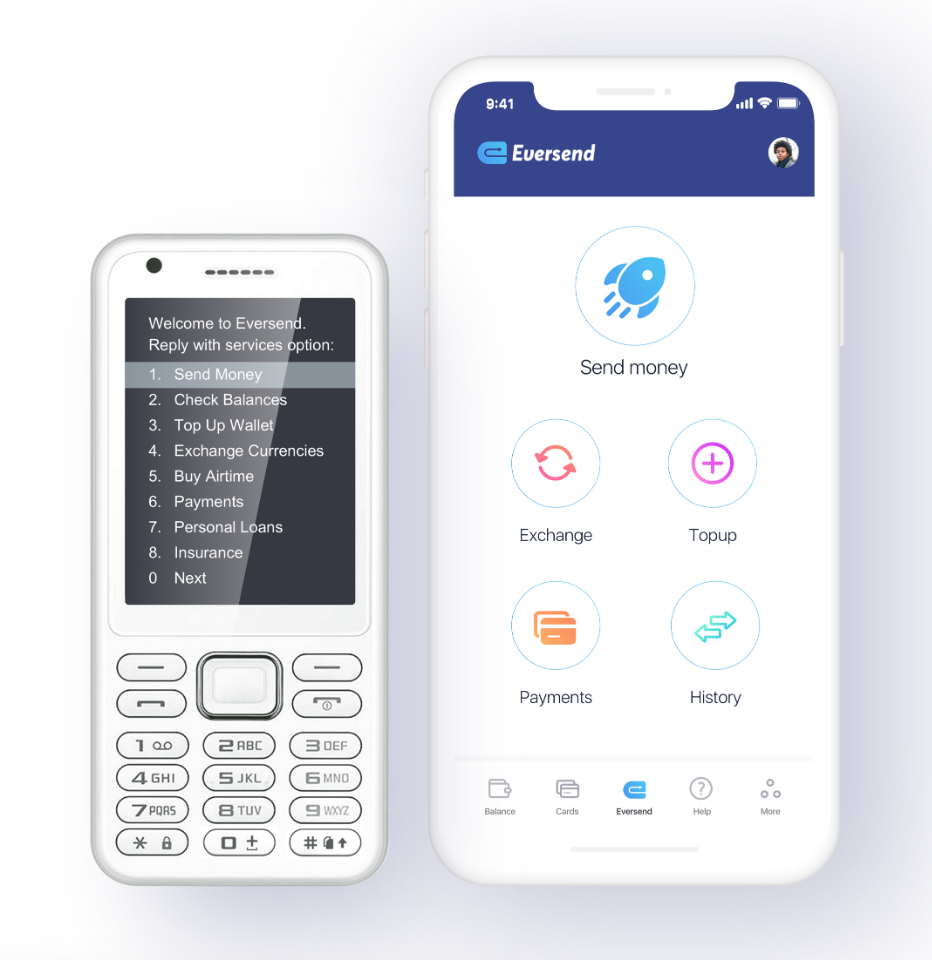

Eversend user interface facilitates cheap money transfers between mobile money networks