How is technology like ours changing the way we serve these communities?

Eversend reflects on the case of Uganda in the aftermath of the WFP incident.

The tragedy earlier this week involving the sickness of over 250 people serviced by the World Food Programme’s (WFP) operations in Karamoja has shone light on the humanitarian crisis unfolding in Uganda.

Countless food assistance beneficiaries reported symptoms of food poisoning after eating Super Cereal, a fortified porridge aimed to tackle malnutrition of pregnant and breastfeeding women.

What is the Hunger crisis in Uganda? What is being done to alleviate the situation through technology? We offer four thoughts.

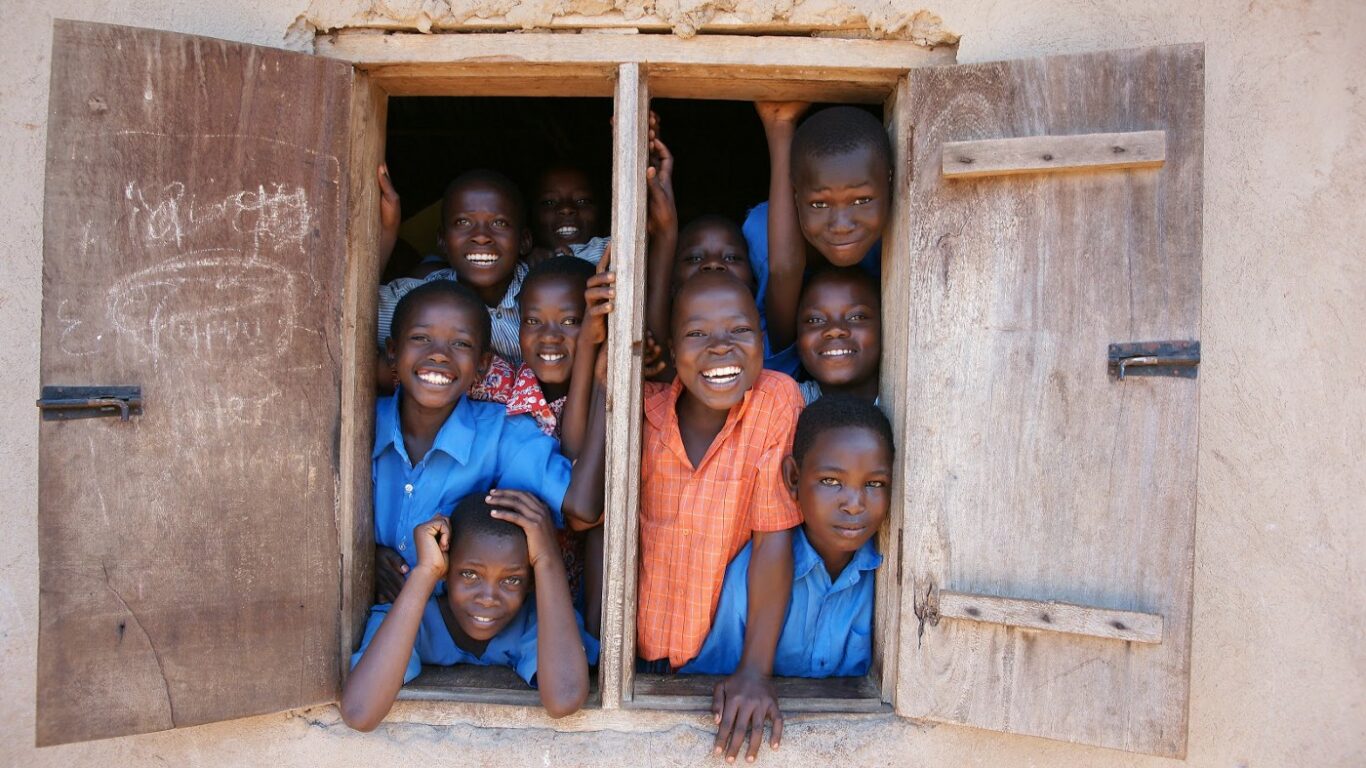

Photo by Random Institute on Unsplash

Uganda

As a heavily agricultural economy with abundant natural resources, Uganda actually suffers from intense food insecurity owing to drought.

Uganda also hosts more refugees than any other African countries. With 1.1 million refugees coming mostly from South Sudan, Democratic Republic of Congo and Burundi. Many are women and children.

Together, refugees and locals alike face issues of poverty and hunger.

According to the World Food Programme:

- Half of all Ugandans consume less calories than they need daily.

- 1 out of 3 children go without food during the school day.

- Stunting, impaired growth and development, is suffered by 40% of children in Uganda.

- This is felt most heavily by refugees, 90% of whom feel the effects of food insecurity and malnutrition

Photo by Alex Radelich on Unsplash

Funding challenges to crisis relief efforts

With an increase in large scale crisis, there’s a drastic increase in the number of people that are targeted to receive aid. This hasn’t been matched with similar increases in funding.

E.g. The World Food Programme operates in Uganda to combat local food and health challenges, with heavy emphasis on Sustainable Development Goal #2 Zero Hunger.

As of January 2019, WFP Uganda sees a funding gap of $1.6 million USD , urgently needed to continue its Mother-and-Children Health and Nutrition program in Karamoja, or have it halted in March 2019.

As such, the search is on for solutions to do more with less.

Uses of digital solutions to maximise effective empowerment

1. Greater Resilience via Financial Inclusion

Financial Inclusion refers to the access to formal financial services, often excluded from particular socio-economic groups due to proximity and lack of formal identification.

e.g. Financial Services for Smallholder farmers

Uganda is hugely agricultural.

70% of the population is employed in agriculture, which supplies a significant portion of Uganda’s foreign exchange earnings. Refugees hosted by Uganda are given plots of land to help them become self-sufficient.

However, the increase in refugee count has decreased average size of plot given. The country also suffers from drought.

To get more from less land, solutions and financial tools need to be employed to grow productivity and value.

Better access to financial tools — such as loans and insurance — empowers people to diversify into riskier but high-return cash crops, invest in machinery, protect from seasonal shocks, and yield more value.

These services can be accessed on mobile phones through digital marketplaces provided by financial technology (fintech) startups, such as that of Eversend, a Ugandan-founded service.

Eversend is working to be accessible even on common USSD devices (feature phones, most commonly referred to as old-school Nokias, as compared to smartphones).

Meaningful partnerships can be struck to better serve communities going through agricultural self-empowerment.

This helps combat food insecurity, environmental degradation (through desperate farming practices), and the prevalence of children skipping education to help farm at home.

(More on financial inclusion here.)

2. Sustainable and affordable remittance mechanism

The African diaspora is noted for its strong ties with their home communities. Remittances are sent from abroad to support families that live in a different country.

Refugee populations hosted by Uganda, for example, get extra financial support from families in Canada who send them money. The ability to access overseas funds quickly and conveniently helps families purchase basic necessities and build financial stability.

However, high remittance costs through traditional international money transfer methods take up a large sum of the money from already vulnerable populations.

E.g. Western Union and MoneyGram may take up to 15–20% in commission. Bank transfers take multiple charges from currency exchange to administration.

Built by Ugandan native Stone Atwine who has experienced the pains of sending remittances to his grandmother and wider family from Kenya, France and South Africa, new financial technologies like Eversend are bridging international payment systems like debit cards and domestic mobile money networks.

This provides much more affordable alternatives to exorbitant transfer services.

Families abroad load money onto their Eversend account in USD/KES with their card or MPESA/mobile money.

Send money in Uganda Shillings to mobile money accounts held by recipients

Recipients can make payments from their mobile money or withdraw in cash at the nearest mobile money vendor.

(Overall, less than 1km from registered users at Ugandan refugee settlements, with the exception of the Koboko area)

3. Biometric Verification in assistance delivery

Uganda is undergoing the most ambitious refugee biometric verification exercise in the history of WFP operation.

Photo by WFP/Claire Nevill

Refugees receive assistance in the form of cash or in-kind food.

In the past, workers flipped through papers to manually verify the identity of beneficiaries. The current reform registers and verifies beneficiaries using their biometric data.

E.g. An aid worker scans Maria’s ration card, iris, and fingerprints. And she receives what she’s entitled to within minutes.

“When my eyes and card are scanned, my photo comes up on the screen. I know it’s fair because WFP will give food to the right person,” explains Maria.

Combined with the implementation of universal ration sizes and electronic weighing, the new reforms ensure that aid is given to the right person, at the right amount.

This streamlined process has massively ruled out fraud, corruption, and helps all parties involved to save time to do more of what matters.

4. Digitalised cash-based transfers (CBT)

Aid organisations are transitioning to deliver assistance from in-kind food to unconditional, unrestricted cash . Also known as Cash-based intervention.

This type of assistance is distributed as physical bank notes, mobile money, debit cards, or value vouchers that can be cashed at the market.

Cash-based transfers now make up 35% of WFP’s assistance portfolio , and is adopted when the local market system functions but goods are financially inaccessible due to cost.

This switch:

Increases flexibility and empowers families to make their own choices.

They can buy diverse food products that increase nutritional intake, mirror diets of their home countries, increasing wellbeing and food security. This also prevents negative coping strategies , e.g. selling off valuable productive assets to buy food for immediate needs.

Boosts the local economy.

The multiplier effect of cash assistance: according to a Uganda-based study, per $1 USD given to a refugee, $2 USD goes into the local economy. Beneficiaries purchase from local farmers, who then expand their business efficiency and lead to a long term reduction in cost. Win-win.

Is Convenient.

Instead of carrying a heavy sack of grain to last a month, recipients buy when and as they need from the local market.

Digitalisation of these transfers boosts these benefits.

Cash can be electronically credited to mobile money wallets of people’s phones where there is connectivity.

This allows for –

Speedy distribution of aid, especially in emergencies.

Financial service providers can roll out delivery quickly to registered recipients in matters of days, as compared to weeks. E.g. MTN and Airtel Uganda, the two main telecommunications operators in Uganda, have strong partnerships with WFP in its “CBT Ready” campaigns.

Saving.

Recipients of aid are able to only cash out what they need, and save the rest on their phone balance, enabling long term savings and resilience for future emergencies.

Safety.

Compared to hogging and storing cash.

Related Articles