2021 has been an eventful year — a year of massive growth and challenges at Eversend.

We learned how difficult it is to build in Africa. There’s limited financial infrastructure, and we have had to build a lot of it ourselves. It’s like jumping off a cliff and building a plane as you go, but we have managed to soar. One of the highlights of our year is that we have opened up our APIs to other businesses to solve challenging problems with collections, payouts, and currency conversion.

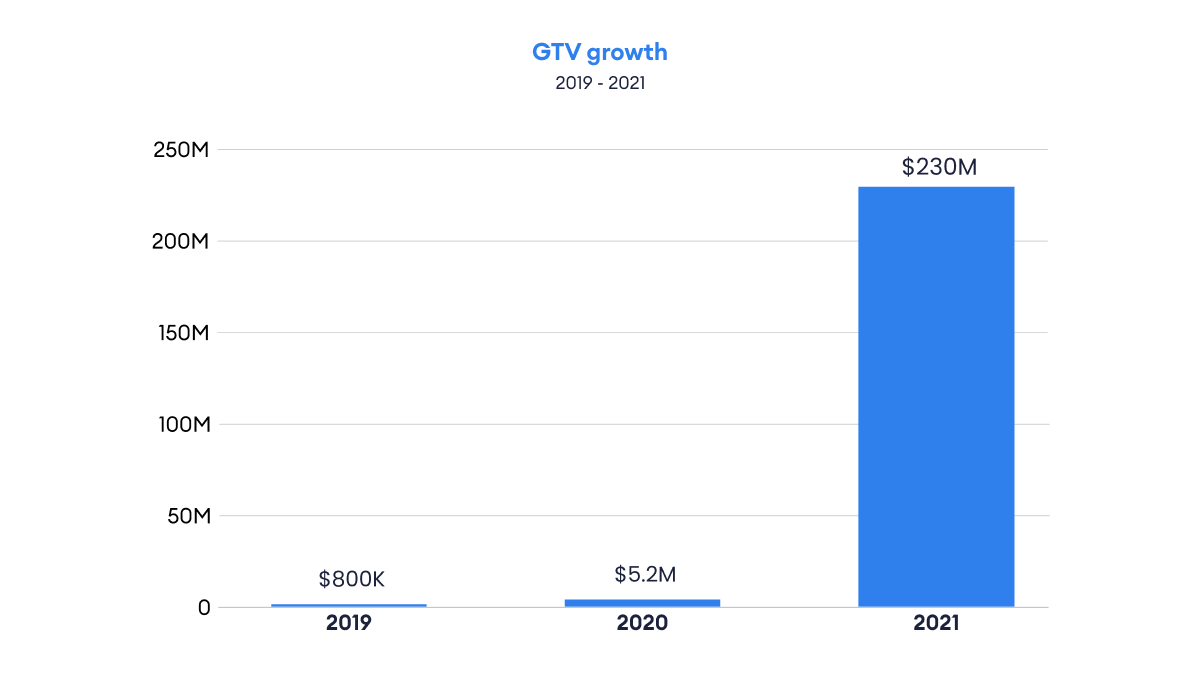

Growth

We are starting to see growth, although we have so far focused on product development.

In 2021 we hit 500K downloads and had a gross transaction volume of $230M, growing from $5.2M in 2020 and $0.8M in 2019. Our obsession with unit economics led us to a 62% gross profit margin and a 1,213% growth in annual revenue, if you like percentages.

Product

A big highlight on the product side is that we cut a high and growing monthly cost on core banking rails. We launched cryptocurrency, starting with stable-coins in Uganda. We have taken our B2B banking and APIs (FX, collections, and payouts) into beta test. We are super excited about the possibilities of solving payments problems for businesses.

We joined a network called “Thepeer’ to allow our users to make payments across different wallets.

Compliance

We shifted focus to regulation and compliance in the latter half of the year. We started to move away from partners and apply for our licenses.

We secured registration in Canada as a money service business. We have also applied or begun the process in 5 other countries.

Team

The team grew from 6 to 15 people, and we had our first in-person get-together in Zanzibar. It was great for all of us to be together, and we plan to do it on an annual basis.

Looking ahead

Not sure if you’ve noticed, but we have never released version 1 of Eversend, and 2022 is the year we get to v1. Our thesis is to build a 1-stop shop for financial services for individuals and businesses. We are looking forward to launching stock trading, interest-earning savings, and asset-backed credit for our B2C app. On the B2B side, we will be working on card issuing and the Eversend Open API.

We are bullish on stable-coins for business payments and solving on/off-ramp and UX challenges in DeFi.

The main focus for 2022 is growth and product optimization. It has been difficult to restrain ourselves from using investor capital as a strategy in a market where startups announce fundraising rounds multiple times a year. We have been patient and proved that we have a business model to generate sustainable growth. And we will now pour some investor fuel on this rocket.

Thank you for being so supportive.